Posted by Yi-Xin Jin (Lily)

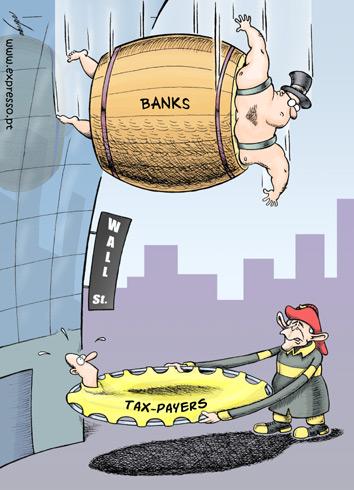

The current crisis is evidence of the reckless investments in highly leverage mortgage-backed securities and derivatives. Niall Ferguson wrote in his article “The Death of Planet Finance”, “The total annual issuance of mortgage-backed securities, including fancy new ‘collateralized debt obligations’ (C.D.O.’s), rose to more than $1 trillion. The volume of ‘derivatives’—contracts such as options and swaps—grew even faster, so that by the end of 2006 their notional value was just over $400 trillion. Before the 1980s, such things were virtually unknown” (Ferguson). Asset backed securities and derivatives have both grown at high rates in the recent years indicating that a lot of mortgages have been lent out, making it more risky for the credit crunch to happen. Despite the risk, investors and highly leverage investment banks still seek highly leveraged projects because of high yields from low interest rates. Various problems have also been occurring in the process of securitization of subprime loans but the real source of the problems lies in the mis-pricing of risk in the financial system.

Banks thought that the house market would keep rising, bringing in more profits without realizing how quickly the mortgages matured. This mis-pricing of risk created a maturity mismatch between the purchased assets and the liabilities that funded these assets in the banking sector. Since most investors preferred assets with short maturities, banks tried to increase profitability by creating off-balance sheet vehicles that would allow them to borrow short and lend long. The process of converting short-term liabilities into long-term assets made banks vulnerable because of the uncertainties in customer demand for repayment and the difficulty in raising new liquid assets.

Banks thought that the house market would keep rising, bringing in more profits without realizing how quickly the mortgages matured. This mis-pricing of risk created a maturity mismatch between the purchased assets and the liabilities that funded these assets in the banking sector. Since most investors preferred assets with short maturities, banks tried to increase profitability by creating off-balance sheet vehicles that would allow them to borrow short and lend long. The process of converting short-term liabilities into long-term assets made banks vulnerable because of the uncertainties in customer demand for repayment and the difficulty in raising new liquid assets.

Sources:

No comments:

Post a Comment