Tuesday, March 31, 2009

2009 College Graduates

Monday, March 30, 2009

The Year of Unsustainability

by Lionel Creech

by Lionel CreechThis article from "The World in 2009" edition of The Economist points out the problems facing businesses, governments, and graduates in the year 2009. Titled "The Year of Unsustainability" it relates to personal finance because when graduates enter the workforce they will have to take into account that sustainability is still a key issue. Graduates should consider companies that have been honest and true to their green policies. "In the competition for the best business-school graduates and other high-flyers, especially once the economy starts to recover, companies that show that they were not mere fairweather friends of sustainability will be at an advantage." Even the way we use our electricity, our households, and manage our transportation should look to maximize our contribution to the sustainability movement. The year 2009 will prove whether or not we will stay true to our sustainable cause during the financial crisis. Click to read the full article

Unemployment Rate Continues to Climb

Posted by Andrew Moran

NEW YORK (CNNMoney.com) -- The unemployment rate jumped last month in 49 states, with Michigan leading the way, the U.S. government reported on Friday. Nebraska was the only state to escape rising joblessness.

The near-collapse of the auto industry pushed Michigan's unemployment rate up to 12% in February, seasonally adjusted, according to the U.S. Department of Labor.

Sky-high unemployment rates were also reported in South Carolina (11%), Oregon (10.8%), North Carolina (10.7%), California and Rhode Island (10.5% each), and Nevada (10.1%).

The most drastic month-to-month increases in the unemployment rate were reported in North Carolina and Oregon, which each saw an increase of 1%. New Jersey also saw a dramatic surge, climbing 0.9% in February.

John Lonski, chief economist for Moody's Investors Service, said that many of these states - including Michigan, Rhode Island and the Carolinas - are struggling because they are heavily reliant on the sluggish manufacturing industry. Click here to continue reading...

Madoff Admits $50 Billion Fraud

5 errors to avoid in a financial crisis

Facing a financial crisis? It's important to make the right moves.

But sometimes what you don't do can be just as critical, says Harvard Law School professor Elizabeth Warren, co-author of "All Your Worth: The Ultimate Lifetime Money Plan." Here are some of her "don'ts" to keep the situation from getting worse as you right yourself financially:

1. Don't borrow more money. Sounds like a no-brainer, right? But in a money crisis, people tend to do the opposite.

"Some people engage in a shell game with themselves," says Warren. "They pay more down to creditors than they really can afford, leaving themselves with no cash." Then they charge current expenses. "They're caught on a treadmill," she says. If you've hit a financial crisis, stop borrowing.

2. Don't cash out your retirement. "There's a reason that money is protected from your creditors," says Warren. "It's there to protect you when you will not be able to provide for yourself."

No matter what you've signed, you shouldn't feel any obligation to use it for debts. "When the creditors made their bargains with you, they never expected to be able to reach your retirement," says Warren. "Don't give it up voluntarily."

POSTED BY: Lee Ruth

Wall Street To Open Lower on Automaker

NEW YORK (Reuters) – Wall Street was set for a sharply lower open on Monday as the Obama administration raised the specter of bankruptcy for two major U.S. automakers and Spain had to rescue regional savings bank CCM.

The administration grabbed control of the failing U.S. auto industry on Monday, forcing out General Motors Corp's (GM.N) CEO, pushing Chrysler LLC toward a merger and threatening bankruptcy for both.

GM shares tumbled more than 20 percent in pre-market trade while Ford (F.N) shed 3.5 percent to $2.74.

"The worst part about this is anyone else who may need government assistance or help realizes that they are in for it; the government will put a heavy hand and tell you what to do," said Joe Saluzzi, co-manager of trading at Themis Trading in Chatham, New Jersey.

"And when government gets involved, most of the time, it's inefficient."

European markets fell after Spain was forced into its first bank rescue since the financial crisis began and Germany and Britain also acted to shore up lenders as the sector awaited the brunt of the impact of rising bad loans.

Stocks fall as automaker plans are rejected

By Angelo Orlando Jr.

By Angelo Orlando Jr.All the major indexes fell more than 3.5 percent, including the Dow Jones industrial average, which lost as much as 300 points in midday trading.

Fears of an automaker bankruptcy have been looming over investors for months, and the latest developments, which included the removal of GM's CEO Rick Wagoner, made the market even more uneasy about the industry.

However analysts said the pullback, which began Friday, wasn't surprising after the Dow surged 21 percent over just 13 days.

The rally began in early March and was fueled by economic and corporate reports that were starting to look more encouraging. Now, investors were taking money out of the market ahead of economic numbers this week and first-quarter earnings in the weeks ahead, fearing that disappointing data will set the market back.

Thursday, March 26, 2009

Cause of the financial crisis

Wednesday, March 25, 2009

A Strategy When Times Are Tough: ‘It’s New!’

- By Kevin Yu

- By Kevin YuPeople say money is the mother’s milk of politics. In marketing, it is new products, meant to pique the interest of consumers and thereby stimulate demand at stores, restaurants and dealer showrooms.

In tough times, it would seem the flow of new products would be slowed by companies fearing that shoppers have too much on their minds to consider still another cereal, soap or soup.

But as the recession grinds on, Madison Avenue is serving up a steady stream of new packaged foods, cars, drugs (prescription and otherwise), menu items (for both sit-down and fast-food restaurants) and beverages (alcoholic and otherwise).

The new product pitches are coming from all manner of marketers, from global behemoths — among them Campbell Soup, General Mills, Mars and Unilever — to family-owned companies like Sargento Foods.

One reason to stay the course on new products is that they can offer marketers new reasons to reach out to consumers when the impulse may be to pull back.

Cold Stone is bringing out, and promoting, new products like ice cream cupcakes, iced and blended coffee drinks, Jell-O Pudding Ice Cream and a line of cheesecakes.

The hope is to amid the changes consumers are making in buying habits. Another reason to keep filling the new-product pipeline is that successful newcomers can bring in much-needed revenue.

Sources:

1. http://www.business24-7.ae/articles/2009/3/pages/03162009_8738d398611041a5a32d08d17daf4034.aspx

2. http://www.acenet.edu/resources/chairs/docs/Boudreaux_ToughTimes_FinalFM.pdf

3. http://www.nytimes.com/2009/03/25/business/media/25adco.html?_r=1&ref=business

China's Role In the Financial Crisis

By Yulun Hung

China has always been known as a country of savers, where most people save about 25% of their annual income, and only 1 in 10 uses a credit card. With so much of the money saved up, China is the second largest United States creditor with $519 billion.

Recently, the Chinese government urges its citizens to spend more and save less, as the country's exports decrease dramatically. Many of Chinese corporations, whether independent or state-owned, are going on a shopping spree for foreign businesses and gaining control of important resources, such as oil.

One country where China falls short of investing is the United States, and with good reasons. Many of "Beijing's conservatism stems from the fact that the global credit crisis has walloped the value of the Chinese government's initial batch of investments in U.S. financial institutions such as Morgan Stanley and Blackstone Group" (Gomez, 2008). Also, "many Chinese investors are still stung by the memory of China National Offshore Oil's 2005 attempt to buy a stake in the U.S. energy company Unocal. The deal fell apart after U.S. lawmakers expressed concern about the national security implications of China controlling some of the country's oil resources" (Juan, 2009).

Sources:

http://www.sfgate.com/cgi-bin/blogs/worldviews/detail?blogid=15&entry_id=31352

http://www.redorbit.com/news/business/264014/china_wants_folks_to_save_less_spend_more/

http://www.washingtonpost.com/wp-dyn/content/article/2009/03/16/AR2009031603293_2.html

US Regulators Want New Powers to Deal With Financial Crisis

Tuesday, March 24, 2009

Credit Crunch, Who Is To Blame?

Bank’s capital ratios has decline drastically in the past few years, due to the excessive amount of leverage in the financial system. This has made banks very vulnerable because high level of leverage indicates shortage of capital cushion. According to the article “Taming the Beast”, “That is why regulators are now rethinking the rules on banks’ capital ratios to encourage greater prudence during booms and cushion deleveraging during a bust”. The Federal Reserve should increase the demand for capital cushion which can lower bank’s leverage and improve market stability.

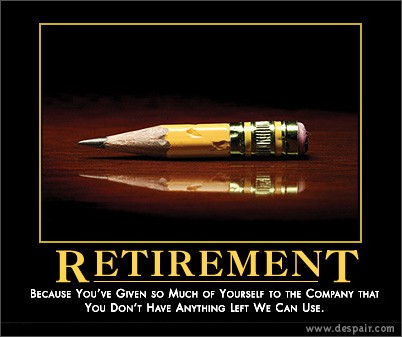

Is it possible to retire anymore?

“Nine months ago [Mark] lost his job as the security manager for the western United States for a Fortune 500 company, overseeing a budget of $1.2 million and earning about $70,000 a year. Now he is grateful for the $12 an hour he makes in what is known in unemployment circles as a “survival job” at a friend’s janitorial services company. But that does not make the work any easier.” (NYTimes.com)

Stories such as this are all too common in recent months. Tragic stories flood the news full of grief and despair from ex-CEO’s, Wall Street hot shots to everyday positions such as high school teachers and farmers. All across the country men and women are losing their jobs by the thousands and are being forced into working wherever they can just to get by.

Not only are people accepting lower paying, lower ranking jobs but it is becoming more common for those retired or about to retire to be reentering the work force. Allan Swank, a 49 year old ex-military soldier and long time factory worker is reformatting his future. A path that once led to a near retirement is being replaced with going back to school to become a teacher. Fortunately for Swank he began this new life path early enough to be finishing up at school this summer and will have his PhD soon next year.

Unlike Allan, David Green of Western Washington University was forced out of the country to find a job. Green is a recent grad looking for a job as a history teacher. Green sent out over 50 applications over the last year landing only two interviews and no job offerings. Green decided to look abroad and plans on teaching in Seoul, South Korea.

It is almost impossible now a days to recession-proof your future. The job market is shrinking by the day and becoming more and more competitive. With all the new plans to save the country’s economy and create new jobs by the Obama administration, hopefully the job market will start to recover.

Sources: 1, 2, 3

Monday, March 23, 2009

South Korea Plans to Spend Record 17.7 Trillion Won

Posted by Pin-Yu Liao

South Korea plans to spend a record 17.7 trillion won ($13 billion) on cash handouts, cheap loans, infrastructure and job training to revive an economy on the brink of its first recession in more than a decade.

The stimulus will boost economic growth by 1.5 percentage points and help create 552,000 new jobs, the finance ministry said in Gwacheon today. The package, equivalent to 1.9 percent of gross domestic product, is more than double the spending in 1998 during the Asian financial crisis.

Dollar Weakened after the Plan Released

By Pin-Yu Liao

Dollar weakened versus the Euro after the U.S. government announced that there will be a bank rescue plan to buy 1 trillion of troubled assets.

The government developed a new plan called the Public-Private Investment Program, which will use tax funds from taxpayers and capital from private investors to buy illiquid mortgage backed securities and other loans in hopes to alleviate the financial crisis targeted at the banks. In this program, the $500 million will be spent on existing troubled assets and loans, those that are in default. It is estimated that 1 trillion will be withdrawn to rescue the banks. The decline in the dollar value is demonstrated in the Dollar Index. The Dollar Index showed that the dollar fell 0.2% against the Euro at $1.3614. The dollar dropped 0.5% versus the pound to $1.4541.

As a result, stocks soared with approximately 4% gain in major indexes, and home sales increased. Existing home sales increased 5.1% last month to the adjusted annual rate of 4.72 million million units.

Hans-Guenter Redeker, London-based global head of currency strategy at BNP Paribas SA, remarked, “The Geithner plan was very well received by the markets, as financials rallied strongly. The dollar should remain under pressure across the board.”

http://money.cnn.com/2009/03/23/markets/dollar/index.htm

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a_ihMaIuO2M0

http://www.forbes.com/2009/03/19/weak-dollar-tight-credit-markets-john-tamny.html

U.S. Expands Plan to Buy Banks’ Troubled Assets

Global Trade will Drop by 9% in 2009

It is said that the trade is shrinking faster than output. It is abnormal, since the trade flows quicker than production. The negative growth leads to another consequence-the job loss related to trade.

In discussing the potential solution to the slowdown of trade, WTO Director-General Pascal Lamy commented, “Governments must avoid making this bad situation worse by reverting to protectionist measures which in reality protect no nation and threaten the loss of more jobs.”

The financial crisis has been the cause for sluggish growth of trade, when some business is out of credit and unable to pay off its debts.

Even China, one of the most dominant trading exporters in the world, suffered from recession and slow global trade.

While some trading partners were enduring sluggish imports and exports, some Asian economies such as China, Singapore, Taiwan and Vietnam have shown positive import growth. The USA recorded the 2.17 trillion of imported goods, even though its import went down by 4%.

Economic crisis creating family crisis

Posted by Yulun Hung

Posted by Yulun HungWritten by Melissa Smith

(Financial Article 1)

TRAVERSE CITY -- Phone lines at the Women's Resource Center in Traverse City are always open for those individuals in need of its services, but lately calls have been increasing as the economy's status is decreasing.

"I think it started for many of our clients a year, year and half ago. Obviously the number of requests have really skyrocketed in the last six months and we don't know exactly where they'll go from here," says WRC executive director Jo Bullis.

Bullis is talking about families facing domestic violence linked to their financial crisis, who are desperately turning to the center.

In fact, between October and December of last year, the center experienced a 35% increase in the number of people requesting financial and emotional support.

Click Here to Read More.

Financial crisis makes global trade system fairer

Written by Xinhua

Commentary: AIG bonuses follow an American Tradition

(financial market article 2)

Posted by: Liwin Troy Lee

By Julian E. Zelizer

Editor's note: Julian E. Zelizer is a professor of history and public affairs at Princeton University's Woodrow Wilson School. His new book, "Arsenal of Democracy: The Politics of National Security -- From World War II to the War on Terrorism," will be published this fall by Basic Books. Zelizer writes widely on current events

PRINCETON, New Jersey (CNN) -- In the explosion of outrage over the AIG executive bonus scandal, each party has hurled charges at the other. Both parties are blaming each other for rejecting measures that would have limited executive bonuses.

A few Republicans have called for the resignation of Treasury Secretary Tim Geithner -- with efforts to paint him as the Michael Brown of this administration -- and President Obama is promising that this week he will outline more stringent requirements for the financial world.

These partisan accusations miss a bigger factor behind last's week's revelations -- America's middle-way in dealing with business-government relations. In many ways, the bonus scandal was utterly predictable and would likely have happened regardless of which party was in power. And if history is a guide, the populist outrage over the bonuses may not fundamentally change the federal government's relationship to private business.

Traditionally, American politicians in times of crisis have resisted aggressive interventions by government into business which would tamper with managerial prerogatives and profits.

The political value of this strategy has been clear: It helps elected officials in the White House and Congress sell federal programs in a country stubbornly resistant to many kinds of government interventions in the private sector (though often happy with the interventions after they receive the benefits). It also dampens corporate opposition to government programs in moments when such programs are urgently needed.

Dow Jumps almost 500 points

(Financial market article 1)

Posted by: Liwin Troy LeeBy Alexandra Twin, CNNMoney.com senior writer

Wall Street posts its best day since November as investors welcome Obama administration plan to buy close to $1 trillion in bad bank assets.

NEW YORK (CNNMoney.com) -- Stocks surged Monday, recharging the rally, after Treasury's plan to buy up billions in bad bank assets and a better-than-expected existing home sales report raised hopes that the economy is stabilizing.

The Dow Jones industrial average (INDU) gained 497 points, or 6.8%, according to early tallies, posting its biggest one-day point gain since Nov. 21. The S&P 500 (SPX) index rose 54 points, or 7.1%. The Nasdaq composite (COMP) added 99 points, or 6.8%.

"I think the stock reaction is a vote of confidence in the plan," said Jack Ablin, chief investment officer at Harris Private Bank.

He said the stock market is also reacting well because the plan is skewed in favor of the private investor, who only has to be responsible for around 7% of the total in any transaction.

But other analysts were less sanguine. "The plan is a rehash of what we've seen before and it still doesn't resolve the issue of how to value the bad assets," said Stephen Leeb, president at Leeb Capital Management.

"There's a lot of cash on the sidelines, there's a real wish to believe that this is a solution and there has been some good news on the economy lately," he said. "All of that is contributing to a rally as well."

Stocks have gained for the past two weeks, despite tumbling last Thursday and Friday. But that retreat gave investors an opportunity to jump back in Monday, with bank shares leading the advance.

Since tumbling to 12-year lows two weeks ago, the S&P 500 has now rallied 18% as of Monday afternoon. But even with the enthusiasm Monday, the S&P 500 was struggling to hold above 800, a key resistance level that analysts say it will need to surpass if the market is going to be able to make a sustained move higher.

Click here to read more

Top Five Causes of the Financial Crisis

- By Kevin Yu

1. Alternative Realities: The Black-Scholes Revolution

When a market is crashing and no one is willing to buy, it’s impossible to sell short. If too many investors are trying to unload stocks as a market falls, they create the very disaster they are seeking to avoid. Their desire to sell drives the market lower, triggering an even greater desire to sell and, ultimately, sending the market into a bottomless free fall.

2. Blind Faith and/or Greed

Greed–the model had the potential to make enormous sums of money for traders, managers, execs and others in the short-term. And it’s not all Wall Street greed. Ordinary Americans continued to pump money into the system, continued to buy beyond their means. The primary motivation of many was to make a quick buck, even if it meant creating bubble that would clobber everyone in the long term.

3. The Greenspan Put

From the late 80s to the middle of 2000, the myopic Alan Greenspan instituted a policy of lowering interest rates every time there was a hint of a financial crisis. It was reactionary, and robotic. Economic restraint was something Greenspan could not comprehend.

The low interest rates made loans cheap, and housing seem cheaper, creating more demand, increasing prices, and so on. After a while, pervasive blind faith set in.

4. Financial “Modernization”

Many in Congress argued that the repeal of Glass-Steagall would create conflicts of interest, lack of transparency and megabanks that would become “too big to fail.

No one made sure the banks and hedge funds had the assets to cover the losses they guaranteed.

5. Groupthink And Conformity Psychologist Irving Janis defines Groupthink as “the mode of thinking that persons engage in when concurrence-seeking becomes so dominant in a cohesive in-group that it tends to override realistic appraisal of alternative courses of action.”

Sources:

1. http://topics.nytimes.com/topics/reference/timestopics/subjects/c/credit_crisis/

2. http://postpartisannews.com/?p=924

3. http://www.tridentpress.com.au/prod138.htm

U.S. Lays Out Plan to Buy Up to $1 Trillion in Risky Assets

- By Kevin Yu

The Obama administration formally presented the latest step in its financial rescue package on Monday, an attempt to draw private investors into partnership with a new federal entity that could eventually buy up to $1 trillion in troubled assets that are weighing down banks and clogging up the credit markets.

Dow Jones industrial average was up sharply in afternoon trading on Monday, gaining more than 270 points. When the Treasury secretary, Timothy F. Geithner, spoke on Feb. 10 of a bank rescue plan without offering much detail, investors took that as a worrying sign and the Dow fell sharply, losing 380 points.

The success or failure of the plan carries not only enormous stakes for the nation’s recovery but certain political risks for Mr. Geithner as well. At least two Republican lawmakers have called for his resignation. And on Sunday, Senator Richard C. Shelby of Alabama, the ranking Republican on the Banking Committee, told Fox News that “if he keeps going down this road, I think that he won’t last long.”

Initially, a new Public-Private Investment Program will provide financing for $500 billion in purchasing power to buy those troubled or toxic assets — which the government refers to more diplomatically as legacy assets — with the potential of expanding later to as much as $1 trillion, according to a fact sheet issued by the Treasury Department.

Helpful Money Tips for Living in Today's Economy

The FDIC insures deposits up to $100,000 per person. If you have more than $100,000, be sure to spread it around to different banks. Another option could be to invest them in a Certificate of Deposit Account Registry Service (CDARS). If you have over $100,000, CDARS takes your money and distributes it to various banks while keeping it all insured.

2. Save

Be mindful of discretionary spending. Try and cut back on things you may normally not even consider such as dining out and other things that are not essential.

3. Refinance your mortgage

Everything that has occurred on Wall Street caused a huge decrease of interest rates on US Treasury bonds. This usually leads to a decline in long term mortgage rates which will benefit you in the long run.

4. Don’t wait for your worst investments to “recover”.

Your worst investments probably will not recover. Reevaluating your portfolio and taking care of your worst investments will be more beneficial than waiting around for something that probably will never happen.

5. If you are investing for 5 years or more, invest in stock

Shares in today’s economy are much cheaper than they have been in awhile. Investing in them now while they are not expensive can provide higher returns in the future.

Madoff Business Interests Include Mets Owner Wilpon’s Fund

Which sports will survive the Recession?

Intermediate Skis $800. Intermediate ski boots $450. Ski poles $50. Ski helmet $100. Average single day lift ticket $75. Needless to explain any further, with some simple addition you can see the type of financial means required to participate with the extremely popular sport of skiing. In these times of economic crisis when people are cutting back on simple needs such as eating at restaurants, going on vacations, driving less etc. what is the future of these expensive luxury sports. What is the future of any sport after the recession?

Well into this financial recession, new studies have shown changes in many popular sports. For instance sales in the fishing industry, involving reels, rods, and other fishing equipment have jumped significantly. Other sports such as Soccer, Baseball, Football and running are expected to survive easily through this recession. All these sports require minimal costs and are so deeply rooted in American society to survive the ages.

Researchers believe that “X-Games” style sports such as motocross, skateboarding, extreme skiing and snowboarding may suffer during this recession and take a huge hit across the globe. This is due to the high costs of equipment and the constant replacement and daily expenses of many of the extreme sports.

While many of the sports we have grown up with may become a bit less popular in the upcoming years hopefully they don’t fully disappear and we can continue to enjoy them well into the future.

Source

Source

Source

Bilked Victims Looking For Ways To Recoup Their Money

The cheated investors of the Madoff scandal are also looking into recovering their money through a special bankruptcy trustee. According to Mathew Gluck, a Manhattan attorney representing more than 100 of Madoff scandal victims, “said in an interview that he is considering filing an involuntary bankruptcy petition against Madoff, 70, as a way of trying to ensure that investors have a clear shot at Madoff's personal assets." However, the federal prosecutors are aiming to use “draconian forfeiture” powers to seize the assets owned by Madoff and his wife, Ruth, and this may dealy the funds getting to investors. Madoff told the public that the total value of all the assets owned by him and his wife totaling more than 823 million and this is a combination of his business and personal assets. This figure is not even close to the damage cause by the scandal.

World's Forest Impacted by the Financial Crisis

Written By: Liwin Troy Lee

The United Nations "State of the World's Forest" reports finds the financial crisis has had an impact on the world's forest. According to their findings, they found that the global turmoil has caused an reduced demand in wood and as a result has caused a shrinking investments in forest. UN Food and Agriculture Organization states that stronger forest management and larger investments in science and technology are needed to handle the financial crisis and the climate change. Furthermore, the report states that the economic downturn could lead the stop of green policies and defer policy decisions related to climate change.

A Separate report found by the UN Food and Agriculture Organization found that there are opportunities that come from the current crisis. The report finds that increased attention to "greener development" could lead to the development of the forest sector. Some actions could be "planting trees, increased investments in substainable forest management, and active promotion of green building practices and renewable resources." The impact of this found by the report is that 10 million new jobs could be created. The benefits of this is it can decrease poverty while helping the environment.

Sources:

Economic crisis hurts world's forests, too:UN

UN:Financial Crisis Puts Pressure on World's Forests

UN Report: Global Financial Crisis Endangering Forests World Wide

Jump Starting our Credit

Treasury Secretary Timothy Geithner told CNBC that the government's highly-anticipated plan to deal with troubled mortgage loans and assets is just the latest effort to stem the financial crisis.

"It's the next step in the series of efforts we're taking to make sure that the banking system is doing what it should do, which is to provide credit for the economy," Geithner said in a taped interview to be aired on CNBC at 2 pm ET.

The plan announced Monday calls for both private and federal funds to purchase toxic assets, using low-cost government financing, government guarantees and government equity as incentives.

Under a typical transaction, for every $100 in soured mortgages being purchased from banks, the private sector would put up $7 and that would be matched by $7 from the government. The remaining $86 would be covered by a government loan provided in many cases by the Federal Deposit Insurance Corp.

How GE dug itself deep into crisis

Now the financial crisis is set to topple U.S. manufacturing stalwarts, the companies that actually build things in this country, from airplane engines to medical equipment, high-end motorcycles to military aircraft.

After finding how easy it was to make money by acting like a bank, they branched into lending that had nothing to do with their core businesses, making loans that in many cases are now going bad. GE now funds things as varied as commercial-real-estate ventures, subprime loans, emerging market debt and credit card lending. Besides making aircraft, Textron funds golf courses, vacation resorts and recreational vehicle sales. Harley-Davidson, at least, stuck to motorcycles. But it became a big player in the asset-backed-securities market, repackaging its bike loans into debt instruments and selling them at a profit to investors. That market has vanished.

How to get out of debt

Under 35? Hurray for the meltdown!

MSN Money

If you're 35 or older, the financial crisis may seem to have no upside. Your retirement funds, home equity, job prospects and credit lines have withered so much that it's hard to focus on anything but what you've lost.

If you're young, though, the biggest threat to your future financial security isn't the current crisis. Your greatest risk is that fear will cause you to miss some once-in-a-lifetime opportunities.

Houses are on sale. Home prices are down 27% from their July 2006 peaks, according to the S&P/Case-Shiller Home Price Indices, and values have fallen more than 40% in some areas. That's a bummer for current homeowners but a boon for those just starting out who can now afford better homes and neighborhoods than they could have just a few years ago.

Interest rates are still near generational lows but are likely to shoot up once the recovery begins.

The Internal Revenue Service will give you an $8,000 tax credit if you buy before Dec. 1.

Bank plan and Stock Market

Posted by: Allison Franklin

Program to remove some $1 trillion in bad assets from their books

NEW YORK - Wall Street is getting the good news it wants on the economy’s biggest problems: banks and housing.

Investors reignited a two-week rally Monday, cheering the government’s plan to help banks remove bad assets from their books as well as a report showing a surprising increase in home sales. Major stock indicators jumped more than 3 percent including the Dow Jones industrial average, which surged 450 points.

The Treasury Department’s bad asset cleanup program would tap money from the government’s $700 billion financial rescue fund and also involve help from the Federal Reserve, the Federal Deposit Insurance Corp. and the participation of private investors.

Treasury Secretary Timothy Geithner had announced an outline of the program last month but provided few details then about how it would work, leading to a poor reception in the markets.

US Financial Bailout

Posted by: Allison Franklin

Mon Mar 23, 2009 1:24pm EDT

WASHINGTON (Reuters) - The U.S. financial system still faces risks requiring government intervention to avoid a more destructive recession, President Barack Obama said, before a critical week of fleshing out and selling his recovery plan.

Obama's steps to reverse a deep U.S. economic downturn and restructure the ailing banking system have global implications as he prepares to meet fellow leaders of major developed and developing nations at a Group of 20 summit in early April.

But his reform plans and vast spending envisioned to reboot the world's largest economy and purge U.S. banks of at least $1 trillion in "toxic" assets face steep resistance from some in Congress and corporate boardrooms.

In a key part of the agenda, Treasury Secretary Timothy Geithner is due to unveil long-awaited details of his bank bailout plan at 8:45 a.m. EDT on Monday.

"I think that systemic risks are still out there," Obama said in an interview with the CBS program "60 Minutes" aired on Sunday.

Stocks spike on bank plan

Wall Street welcomes Obama administration plan to buy up close to $1 trillion in bad bank assets.

By Alexandra Twin, CNNMoney.com senior writerPosted by: Liwin Troy Lee

NEW YORK (CNNMoney.com) -- Stocks continued their rally on Monday afternoon as investors hailed Treasury's plan to buy up billions in bad bank assets, seeing it as a critical move in stabilizing the financial system.

The Dow Jones industrial average (INDU) gained 315 points, or 4.3%, over 2-1/2 hours into the session. The S&P 500 (SPX) index rose 34 points, or 4.5%. The Nasdaq composite (COMP) added 61 points, or 4.2%.

"I think the stock reaction is a vote of confidence in the plan," said Jack Ablin, chief investment officer at Harris Private Bank.

He said investors are glad to have details about the plan because previous Obama administration announcements failed to give enough specifics.

He added that the stock market is also reacting well because the plan is skewed in favor of the private investor, who only has to be responsible for around 7% of the total in any transaction.

Barack Obama woos private investors for $1 trillion toxic asset plan

The US government could not bear sole responsibility for getting credit markets functioning again, Mr Geithner insisted. "For these programmes to work, investors have to be prepared to take some risk."

Sunday, March 22, 2009

U.S. Rounding Up Investors to Buy Bad Assets

The talks came a day before the Treasury secretary, Timothy F. Geithner, planned to unveil the details of the administration’s long-awaited plan to purchase troubled assets, meant to remove them from the balance sheets of banks and, in turn, spur banks to lend more money to consumers and companies.

The plan relies on private investors to team up with the government to relieve banks of assets tied to loans and mortgage-linked securities of unknown value. There have been virtually no buyers of these assets because of their uncertain risk.

Wednesday, March 18, 2009

Chickens and Cows are the Solutions to the Financial Crisis?

By Yulun Hung

As banks are becoming fearful of lending money to people with little money, Nobel Prize winner Muhammad Yunus believes microfinance lending to the poor can return our economy to health. Yunus thinks loans of much smaller size, backed with less valuable assets such as chickens and cows, can increase the flow of capitals.

Muhammad Yunus says his formula can work all over the world, even in developed countries such as the United States. To prove his statement, Yunus cites the success of his latest creation, microfinance bank, Grameen Bank. The bank has lent out $6 billion to date with 8 million borrowers each month, paying it back 99% of the time. The 99% doesn't change even in high unemployment and poor neighborhoods, such as Jackson Heights, New York.

Muhammad Yunus critized current government actions of trying to solve the financial crisis. Many economists and bankers argue Yunus' solution is unrealistic, but the fact is Grameen Bank has more solid profolios of loans than many big banks. In conclusion, Muhammad Yunus once said, "The solution is for the market to find a solution, not for the government to bail out a defective system."

Sources:

http://www.forbes.com/2009/03/18/Yunus-Microfinance-grameen-markets-economy-loans.html

http://muhammadyunus.org/content/view/164/128/lang,en/

http://www.businessweek.com/innovate/content/oct2008/id20081013_307979.htm?campaign_id=rss_daily

Rising Liquidity Concerns

According to the article Block pipes from the Economist print, the collapse of one the sub-prime lenders Lehman Brothers, followed by the long series of rescue in Europe and America, seems to have brought the money markets close to breakdown. Companies were not able to provide credit to retail and corporate clients because money markets were not ‘‘behaving normally.’’ Rates on loans are set with reference to money markets. The higher rates for banks mean higher rates for everyone. If a market was blocked for a week or more companies may find it hard to finance at any price causing more bankruptcies and job losses, and making investors more risk adverse. Since many companies are highly dependent on these money markets, financial crisis will not recover if money market situations are not cleared, thus tougher regulations should be implemented.

OPEC, IMF Say Lower Oil May Cause Crunch as Economy Recovers

OPEC and the IMF said lower oil prices are cutting investment in new fields, risking a supply crunch when the global economy recovers.

“I don’t think that with a $40 price, or $45 a barrel, as we see it now, we can invest in any additional capacity,” the Organization of Petroleum Exporting Countries’ secretary- general, Abdalla El-Badri, said today at a seminar in Vienna hosted by the group. Lower prices have forced OPEC nations to delay 35 of 150 planned production projects, he said.

Fed Pumping $300 Dollars into Treasuries

It is reported that there are more job loss occurrences this year, the drop in values of stocks and bonds, and lesser consumer spending. After the news came out, there is an indication of inflation this Wednesday, and the Fed will carry out its plan to reach the potential inflation. The Fed asserted it "sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term." The Fed is worried about deflation, because the falling prices will suppress the output and employment which drives down the economy faster. On the other side, the consequences of Fed’s decision to buy treasuries and mortgage backed securities bring the dollar weak. The weaker value in dollar causes the Americans to pay higher prices for imported goods such as oil.

Fed to Buy $1 Trillion in Securities to Aid Economy

:Copied and Pasted By Xavier Guerrero

Saying that the recession continues to deepen, the Federal Reserve announced Wednesday that it would pump an extra $1 trillion into the mortgage market and longer-term Treasury securities in order to revive the economy.

“Job losses, declining equity and housing wealth, and tight credit conditions have weighed on consumer sentiment and spending,” the Fed said, adding that it would “employ all available tools to promote economic recovery and to preserve price stability.”

As expected, the Fed kept its benchmark interest rate at virtually zero. But in a surprise, it dramatically increased the amount of money it will create out of thin air to thaw out the still-frozen credit markets that have cramped lending to consumers and businesses alike.

Indeed, the immediate effect on the bond markets was striking, with prices rising and yields dropping sharply on the news. The yield on the 30-year Treasury bond, about 3.75 percent before the announcement, fell quickly to 3.4 percent and remained volatile. At the same time, the dollar plunged about 3 percent against other major currencies.

Stocks moved higher on the Fed action. The Dow Jones industrial average was down about 50 points before the 2:15 p.m. announcement, but ended the day up about 90 points.This is a great informative article, click here for more information.

Sources:

New York Times

Business Week has a small piece on it as well

How to Survive the Financial Crisis?

Written by: Liwin Troy Lee

1. Refinance your home mortgage. Try to find a deal to lower your monthly payment. Consolidate your loans if possible.

2. Get a second job or find a way to get an extra source of income. Some examples could be having a garage sale or a bake sale to raise money.

3. Save your money as much as possible. Do not spend money on luxuries. Only spend money on the necessities. Find ways to lower the cost of gas, electricity and food.

4. Limit the use of your credit card. Do not spend money you do not have.

5. Ask family, relatives and friends for help if you need money. Pay them back, so they will lend to you again next time.

6. Help one another solve the Economic crisis.

Sources

How to Deal with Financial Crisis?

How to Survive the Financial Crisis?

Survive the Crisis

Surviving the Financial Crisis

Tuesday, March 17, 2009

How to Avoid Unemployment in Society

- By Kevin Yu

Since 2007 (December), I have been hearing job layoffs from the news. Recently, I believe the situation has got worst with overall unemployment rate stands at 7.2 percent, a 15-year high according to Bureau of Labor Statistics. There are seven steps of how to avoid getting fired:

Step 1

Improve on levels of education by training job creators instead of job seekers.

Step 2

Maintain political stability in order to attract more investors who can invest in different businesses.

Step 3

Promote agriculture and farming mainly in rural areas to improve employment opportunities.

Step 4

Promote exports instead of imports in order to increase on national income which can lead to future employment opportunities.

Step 5

Promote industrial development by using land tenure system and tax holidays in order to attract both local and foreign investors.

Step 6

Promote sports, music and drama to enable the youth get employed.

Step 7

Extend credit facilities mainly in rural areas to help the poor get access on finance through loans and grants in order to start their own jobs.

Sources

1. http://www.mint.com/blog/moneyhack/a-visual-guide-to-the-financial-crisis-unemployment-rates/

2. http://www.telegraph.co.uk/finance/financetopics/financialcrisis/3166706/Financial-crisis-Rising-unemployment-on-the-way-as-recession-looms.html

3. http://www.ehow.com/how_2161379_avoid-unemployment-society.html

Wall Street firm part of the solution, not the problem

Copied by Yulun Hung

Copied by Yulun HungWritten by Garett Sloane

Wall Street is being vilified for leading the world to financial ruin, but from those same doomed streets one company hopes to play the savior.

On March 31, the Wall Street company SecondMarket is set to open the trading floodgates on “toxic assets” that are dragging down banks and their ability to lend.

“We really are part of the solution,” said Barry Silbert, CEO of SecondMarket. “The stuff that is clogging up our system right now, it’s pretty common for a commentator or an expert to say, ‘If only a market existed.’ And from that perspective we are becoming [that market], and so we are going to help provide clarity on pricing. We are going to help unclog the system.”

The “stuff” in the system is the toxic assets — or mortgage-backed securities — that have proved hard to price and sell, partly because there is no transparent market to trade them. Uncle Sam owns plenty of the assets thanks to the financial bailout.

Click Here to Read More.

Monday, March 16, 2009

Posted by: Liwin Troy Lee

Group 5B

Obama tries to stop AIG bonuses: How do they justify this outrage?

ASHINGTON (CNN) -- President Obama said Monday he will attempt to block bonuses to executives at ailing insurance giant AIG, payments he described as an "outrage."

"This is a corporation that finds itself in financial distress due to recklessness and greed," Obama told politicians and reporters in the Roosevelt Room of the White House, where he and Treasury Secretary Tim Geithner were unveiling a package to aid the nation's small businesses.

The president expressed dismay and anger over the bonuses to executives at AIG, which has received $173 billion in U.S. government bailouts over the past six months.

"Under these circumstances, it's hard to understand how derivative traders at AIG warranted any bonuses, much less $165 million in extra pay. I mean, how do they justify this outrage to the taxpayers who are keeping the company afloat?"

Obama was referring to the bonuses paid to traders in AIG's financial products division, the tiny group of people who crafted complicated deals that wound up shaking the world's economic foundations.

The president said he has asked Geithner to "pursue every single legal avenue to block these bonuses and make the American taxpayers whole."

Obama spared AIG's new CEO, Edward Liddy, from criticism, saying he got the job "after the contracts that led to these bonuses were agreed to last year."

But he said the impropriety of the bonuses goes beyond economics. "It's about our fundamental values," he said."All across the country, there are people who are working hard and meeting their responsibilities every single day, without the benefit of government bailouts or multimillion-dollar bonuses. You've got a bunch of small-business people here who are struggling just to keep their credit line open," Obama said.

Click here to read more

Fed Preview

Posted by Stephen Mills; Group1A

As they prepare to open a two-day meeting Tuesday, Federal Reserve policymakers are weighing whether to launch new programs or expand existing ones to spur lending, get Americans spending again and lift the country out of recession.

Any decisions would come Wednesday.

To try to revive the economy, Fed Chairman Ben Bernanke and his colleagues already have slashed a key lending rate to banks to a record low.

Economists predict the Fed will leave that rate near zero at this week's meeting and probably through the rest of the year.

The financial crisis has thrown millions of Americans out of work and forced a growing number of banks out of business.

The Fed's efforts have helped ease some credit and financial stresses. But those markets are still far from operating normally, Bernanke and other Fed officials have acknowledged.

"The world is suffering through the worst financial crisis since the 1930s," Bernanke said in a speech last week.

"Until we stabilize the financial system, a sustainable economic recovery will remain out of reach." But the Fed chairman does believe America's recession "probably" will end this year if the government does succeed in bolstering the banking system.