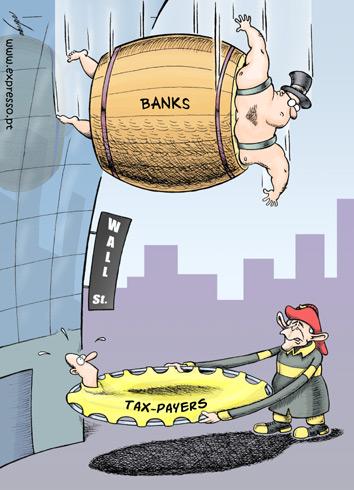

Americans' net worth fell in 2008, erasing four years of gains, as the value of their houses and stock portfolios declined, according to new data from the Federal Reserve (.pdf file).

Household assets as a whole fell 15% to $65.7 trillion, unadjusted for inflation, compared with a decline of less than a percentage point to $14.2 trillion in total household liabilities.

The net worth of American households -- the difference between assets and liabilities -- was $51.5 trillion, down $11.2 trillion, or nearly 18%, from 2007. That sets Americans' total wealth back to levels lower than in 2004. It was the first decline in American household net worth since 2002.

The Fed data signal the end of an era where Americans spent with an eye on their growing assets -- their homes, retirement funds and stock investments.

An increase in spending that accompanies such a perceived increase in wealth is known as the "wealth effect," and economists calculate that it led Americans to spend about $1.05 for every dollar gained. Now, as Americans' assets shrink, they are spending less.

"The hit to the American family is so broad and so deep," said Jane D'Arista, a research associate at the Political Economy Research Institute at the University of Massachusetts-Amherst.